8 money saving tips for tradespeople

Whether you’re just starting up or you’re a long-timer in a trade, budgeting is a key skill for all self-employed tradespeople. But, with all the other responsibilities that come with running your own business, you can quickly run out of time to spend on streamlining your finances.

If you’re looking for ways to cut your everyday expenses quickly and easily, check out our 8 money saving tips specifically for tradespeople, below.

1. Use discount codes

Building materials and fuel are amongst the supplies that you expect to buy on an almost daily basis as a tradesperson. Make those inevitable costs cheaper by using discount codes when you’re buying them online.

At Rated People, we’ve made it easier for our tradespeople to find relevant discount codes by offering over 200 discounts in one place – Member Benefits Premium. There are discounts available at trade counters, fuel pumps, on your business bills and more.

Read more about how to save money daily with Rated People’s Member Benefits Premium.

2. Take advantage of free van advertising

By branding your van, you can promote your business to thousands of pedestrians and other road users, 24/7. Plus, it’s a low-cost way of advertising your services, because the space on your van is free advertising space. So, once you’ve paid for your branded stickers, wraps or signs, you won’t have to pay for anything else!

Find out what the different van branding options are on our Trade Advice Centre.

3. Be more energy-efficient

Not only will making the switch over to greener products reduce your carbon footprint, but it’ll also help you save money on energy bills, fuel and food costs:

- Switch to an electric vehicle: A low emission vehicle will mean you avoid any daily clean air zone charges. Plus, the cost per mile of electricity is lower than petrol or diesel, and electric vehicles often have lower maintenance costs. This is because they have fewer moving parts that could need fixing or replacing.

- Install a smart heating system: Do you have an office? If you do, move over to a smart energy system to see the cost of the energy you’re consuming and ways to reduce your usage, on your smartphone or computer.

- Buy reusable products: Once you’ve paid the upfront cost of flasks and reusable water bottles, you won’t have to cough up the cash to buy drinks every time you’re on a job. So, they’ll pay for themselves after a few uses! Plus, it’ll help you reduce contact with the homeowner, which is essential for working in homes safely during COVID-19.

Check out more tips on making your business more eco-friendly.

4. Claim allowable expenses

Uniforms, protective workwear and work-related fuel costs are all examples of business expenses that you don’t have to pay tax on. Plus, there are certain items that you use for both business and personal use, which you can partially claim as allowable expenses.

Keep records of all your business expenses and put the details on your Self-Assessment tax return.

Find out exactly what taxable and allowable expenses are for self-employed tradespeople.

5. Automate your admin

The average UK small to medium sized business spends around three months on admin every year, according to Sage. That’s precious time that you could be spending on the tools! Reduce the amount of time that you spend sending invoices, by upgrading to automated e-invoicing.

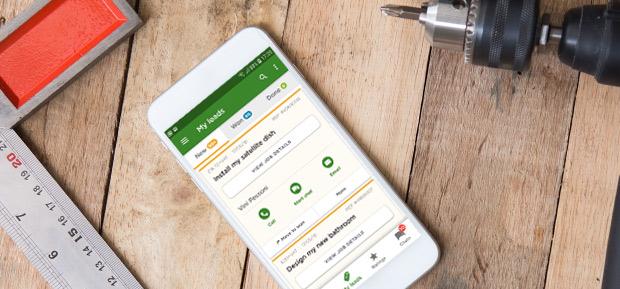

Plus, with a Rated People membership, you’ll save time on arranging your job leads through our exclusive Lead Tracker feature. It shows you the details of each of your leads (from Rated People and elsewhere), as well as how much value each lead’s bringing in, in one place.

Access 75,000 leads a month and build your reputation online.Enquire now

6. Shop around for van insurance premiums

Noticed your van insurance quotes steadily increasing every year? There are some things that you can do to cut down the price you’ll pay.

When it’s time to renew your insurance, don’t just accept the auto-renew quote. Spend some time shopping around, improving your van and, if you’re up to it, haggling. You could dodge a price hike or even lower your premium.

Take a look at 10 essential tips to save money on your van insurance.

7. Apply for government financial support if you’re facing reduced demand

The government has put together a package of coronavirus support worth billions, to support UK businesses facing difficulty during the COVID-19 pandemic. There are cash grants, loans and more available to support you if you’re facing reduced demand.

Read more about the latest coronavirus government support for tradespeople.

8. Invest in your tools

Your tools are essential to your business, so it’s important to take care of them. If you invest in quality and robust tools from the start, then it’s less likely that you’ll need to replace them later down the line. This makes them cheaper in the long run – plus there are other benefits. High quality tools often give your work a better finish, help you avoid injury through an ergonomic design and can help you complete your work more efficiently.

That being said, specialist tools can be expensive to buy or replace. Get tool insurance to cover the cost of replacing your tools if they’re lost, stolen or damaged, so you won’t have to fork out for a whole new set at once or be forced to turn down clients whilst you’re out of action.

From tools to gadgets, there’s deals on insurance packages available to our tradespeople on Rated People Member Benefits Premium. If you’re not already a member of Rated People, fill in our form and we’ll call you back for a chat.

Access 75,000 leads a month and build your reputation online.Enquire now